As many of you are starting to have your first part time jobs, It is important to learn how to budget. Budgeting is basically a plan for your future income and expenses. You use this plan as a guideline for spending and saving. There are simple steps on how to budget:

1. Add Up Your Income

2. Estimate Your Expenses

3. Find Out the Differences

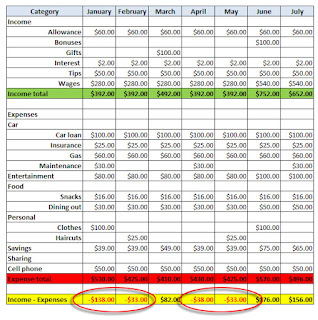

If you are currently working part time you have a close estimate of how much money you earn per paycheck. Then you need to figure out your expenses. This can include gas, car insurance, and etc. Once you found the difference, hopefully, you have more income than expenses. You can figure out how much money you have for miscellaneous for going out, video games, and etc. You usually have a set budget every month, but at times it will change. For instance, if you are planning on purchasing Christmas presents next month, you need to budget that in. You can create your budget on Excel, websites, such as Mint.com, or even by hand with a pen and paper.

Learning how to budget is extremely important. It is a skill you will be using for the rest of your life. Something I do suggest is if you have leftover income you should deposit that into a savings account. This allows you to save for a rainy day. For instance, it allows you to pay for something you did not budget for initially.

|

| Example of a 6-month Budget Plan |

Works Cited